Table of Contents

Credit cards are more than just a way to pay for stuff. They can also help you earn rewards, build your credit and get access to cool perks. With so many options out there, it can be very difficult to figure out which credit card is right for you. Whether you’re a frequent traveler, a big fan of cashback or someone who’s just starting to build your credit, there’s a credit card out there that’s perfect for you. In this guide, we’ll take a look at the best credit cards for 2024, and we’ll tell you all about their features, benefits, and why they’re worth considering.

8. The Platinum Card® from American Express

Established for the sophisticated consumer and providing a lavish credit card application for those who travel often, the Platinum Card® encompasses comfortable airport lounge access and other privileges.

Key Features:

- Rewards: Get 5 points per dollar spent on flights and at Amex Travel for hotels and 1 point for all other purchases.

- Sign-Up Bonus: Earn 80,000 Membership Rewards® Points after spending $6,000 in the first six months.

- Perks: Access to over 1,400 airport lounges, annual travel credits and complimentary hotel elite status.

- Annual Fee: $695.

- Pros:

- Unmatched travel perks.

- High rewards rate for travel bookings.

- Extensive lounge access.

- Cons:

- High annual fee.

- Rewards aren’t as flexible as competitors.

Who Should Get It?

There are segments of consumers who wish to have simple cash back rewards without any restrictions on the category of purchases they need to make.

7. Wells Fargo Active Cash® Card

The Wells Fargo Active Cash® Card is designed to provide a straightforward method of earning and receiving a flat cashback without paying an annual fee.

Key Features:

- Rewards: Earn unlimited 2% cashback on all purchases.

- Sign-Up Bonus: Earn a $200 cash rewards bonus after spending $1,000 in the first three months.

- Perks: Intro APR for purchases and balance transfers. No category tracking required.

- Annual Fee: $0.

- Pros:

- Simple rewards system with no categories.

- No annual fee.

- Intro APR offer.

- Cons:

- Limited travel perks.

- No bonus categories.

Who Should Get It?

There are segments of consumers who wish to have simple cash back rewards without any restrictions on the category of purchases they need to make.

6. Blue Cash Preferred® Card from American Express

Combining the features of this card with the opportunities offered by the Blue Cash Everyday® Card makes our second choice the best card for families with large grocery and streaming service expenses.

Key Features:

- Rewards: Earn 6% cashback on groceries (up to $6,000 annually), 6% on select streaming services, 3% on transit and gas, and 1% on other purchases.

- Sign-Up Bonus: Earn a $250 statement credit after spending $3,000 in the first six months.

- Perks: Monthly cashback rewards and awesome spending category bonuses.

- Annual Fee: $95 (waived for the first year).

- Pros:

- Save big on groceries and streaming with our high cashback rate.

- Transit and gas rewards also help with the boost and flexibility.

- Waived annual fee for the first year.

- Cons:

- Grocery rewards are capped annually.

- Annual fee after the first year.

Who Should Get It?

Families and households with significant grocery and streaming expenses will maximize value with this card.

5. Discover it® Cash Back

The Discover it® Cash Back card is well-loved for its over-restricted 5% cashback categories and an even more specific first-year cashback match.

Key Features:

- Rewards: Earn 5% cashback in quarterly rotating categories (on up to $1,500 per quarter, activation required) and 1% on all other purchases.

- Sign-Up Bonus: Cashback Match – Discover matches all cashback earned in the first year.

- Perks: No annual fee, free credit score monitoring, and zero fraud liability.

- Annual Fee: $0.

- Pros:

- Exceptional first-year cashback potential.

- No annual fee.

- Rotating categories offer high rewards.

- Cons:

- Rotating categories require activation.

- 5% rewards are capped.

Who Should Get It?

This card is perfectly suitable for cashback lovers who are ready to monitor and remember about changing monthly bonuses.

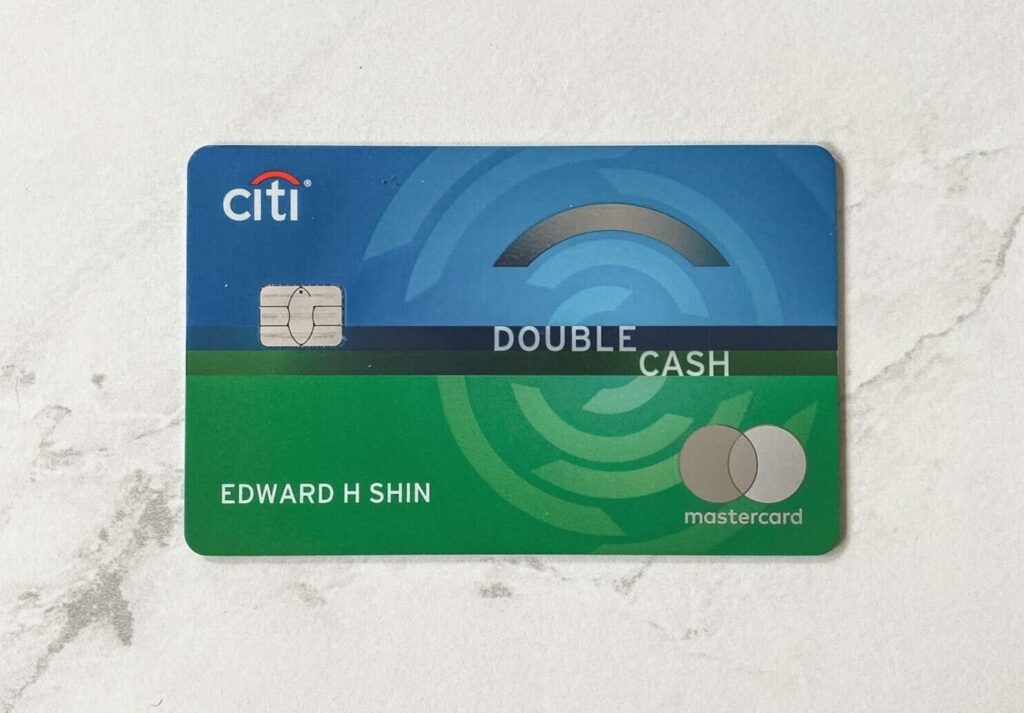

4. Citi® Double Cash Card

The Citi® Double Cash Card is the best cashback credit card if you want to earn cash back consistently on all the things you buy.

Key Features:

- Rewards: Earn 2% cashback on all purchases (1% when you buy and 1% when you pay).

- Sign-Up Bonus: No traditional bonus, but it offers a balance transfer intro APR for 18 months.

- Perks: No annual fee and flexible redemption options, including cashback and points transfer to Citi’s partners.

- Annual Fee: $0.

- Pros:

- Simple, flat cashback structure.

- No annual fee.

- Intro APR for balance transfers.

- Cons:

- No bonus categories or upfront sign-up bonus.

- Foreign transaction fees apply.

Who Should Get It?

This card is ideal for such a person who wants an uncomplicated, lucrative cashback program to enjoy on his/her spending without bearing any yearly charges.

3. Capital One Venture Rewards Credit Card

The Capital One Venture Rewards Credit Card is a basic and uncomplicated travel card with no foreign transaction fee and a flat rate of reward on all purchases.

Key Features:

- Rewards: Earn 2x miles on every purchase.

- Sign-Up Bonus: Earn 75,000 bonus miles after spending $4,000 in the first three months.

- Perks: Redeem miles for travel purchases or transfer to airline partners. Includes travel accident insurance and no foreign transaction fees.

- Annual Fee: $95.

- Pros:

- Easy to understand rewards system.

- Flexible redemption options.

- Competitive sign-up bonus.

- Cons:

- Less valuable transfer partners than other travel cards.

- No bonus categories.

Who Should Get It?

Those who do not wish to be bothered with bonus categories will definitely find this card easy to deal with.

2. American Express® Gold Card

The American Express® Gold Card is a premium option for those who usually dine and grocery shop. One unique feature about the American Express® Gold Card’s reward structure is for food lovers, and people in urban areas.

Key Features:

- Rewards: Earn 4x points at restaurants and on groceries (up to $25,000 annually), 3x points on flights booked directly or through Amex Travel, and 1x point on other purchases.

- Sign-Up Bonus: Earn 60,000 Membership Rewards® Points after spending $4,000 in the first six months.

- Perks: Monthly dining credits (up to $120 annually) and Uber Cash (up to $120 annually).

- Annual Fee: $250.

- Pros:

- High rewards rate on dining and groceries.

- Generous perks and credits.

- Access to Amex Membership Rewards®.

- Cons:

- High annual fee.

- Limited travel partners compared to competitors.

- The annual fee would be too much for occasional travelers.

- No intro APR offer.

Who Should Get It?

This card is a no-brainer if you’re a food lover or a business traveler who wants to score serious dining rewards and flying miles!

1. Chase Sapphire Preferred® Card

The Chase Sapphire Preferred® Card is one of the best choices for travelers and foodies. With rewards on dining and travel purchases, it’s a great choice for those who love to eat and travel!

Key Features:

- Rewards: Earn 3x points on dining, 2x points on travel, and 1x point on all other purchases.

- Sign-Up Bonus: You can earn 60,000 bonus points after spending $4,000 in the first three months, which are equivalent to $750 toward travel from Chase Ultimate Rewards.

- Perks: Points can be transferred to airline and hotel partners or redeemed for travel at a 25% higher value. No foreign transaction fees.

- Annual Fee: $95.

- Pros:

- Flexible redemption options.

- Generous sign-up bonus.

- Excellent for travel perks and protections.

- Cons:

- The annual fee would be too much for occasional travelers.

- No intro APR offer.

Who Should Get It?

If you’re a frequent traveler who loves getting rewards for your trips, the Chase Sapphire Preferred® Card is the perfect choice for you!

Conclusion

To this end, the selection of the most appropriate credit card depends on your consumption pattern, needs and personal objectives. For those who may desire travelling rewards, cash back or exclusive privileges. You are sure to find a card that meets your requirements. Spend some time reviewing your list of priorities and choose the card where you’re likely to get the most for your money.

For more similar content, follow Zntus.

FAQs

What is the best credit card for cashback?

The two best cards to use for earning flat-rate cashback are the Citi® Double Cash Card and the Wells Fargo Active Cash® Card.

Which credit card offers the best travel rewards?

For travelers, two preferred credit cards are the Chase Sapphire Preferred® Card and the Capital One Venture Rewards Credit Card.

What’s the best credit card for families?

The Blue Cash Preferred® Card from American Express is amazing for families with large grocery and streaming bills.

Are credit cards with annual fees worth it?

Yes, so long as the troubling became is valuable more than the annual fee conveyed with relation to your schedules of spending.

What’s the best card for beginners?

The Discover it® Cash Back card is one of the best for newbies since it is free and comes with the first-year cash-back match.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.